- Sienna Miller

- Posts

- The Trade War Isn’t Over

The Trade War Isn’t Over

Look at the numbers, not the vibes

Monday morning I woke up to an urgent text from Robin, who is still visiting friends in Europe: “You have to look at the news NOW.”

Sure enough, Donald Trump had suddenly slashed his tariff on China from 145 percent to 30 percent.

But much of the reporting I’ve seen on this climbdown has been deeply misleading. If you get your picture of what’s happening from “news analyses” rather than experts who actually do the math, you might well think that the Trump trade war is basically over, that we’re back to more or less normal policy.

The reality is that we’ve gone from a completely insane tariff rate on imports from China to a rate that’s merely crazy. And China accounts for only a fraction of our imports.

Tariffs on everyone else are still at 10 percent, a level we haven’t seen in generations. And there are still other shoes to drop: Trump has, for example, been promising tariffs on pharmaceuticals.

The trade war is still very much on. Anyone who reports otherwise:

(a) hasn’t done their homework

(b) is misleading the public.

And while the stock market has to some extent bought into unwarranted optimism, markets with fewer naive investors like oil and bonds don’t seem fooled.

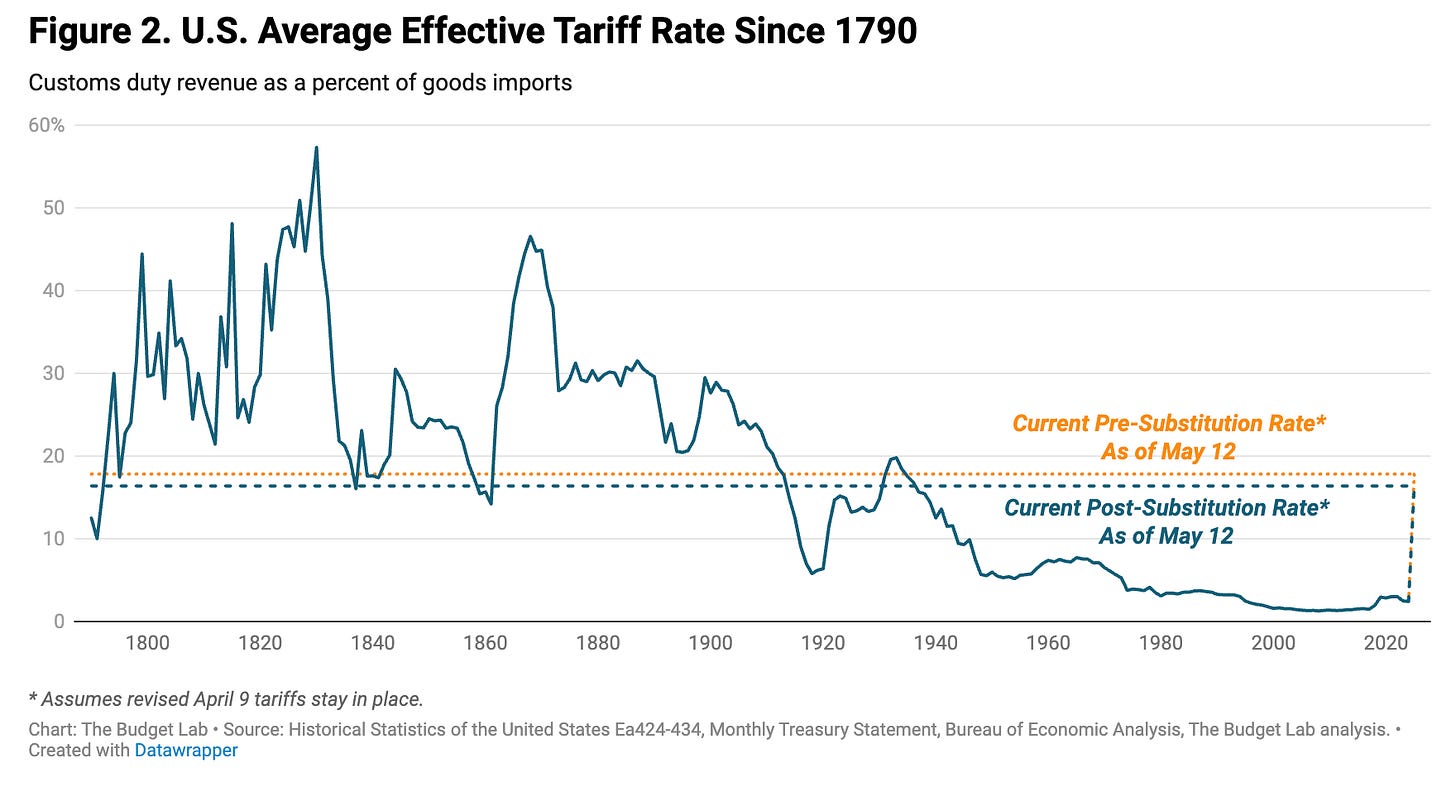

Look first at the average tariff rate. Here’s a chart from the Yale Budget Lab:

If you’re puzzled, the “pre-substitution” rate is currently announced tariffs applied to actual imports, which now stands at 17.8 percent — which is immense.

The “post-substitution” takes into account the fact that China, which is still facing a very high tariff, will soon supply a smaller share of our imports, and is “merely” 16.4 percent.

We’re still looking at overall tariffs not much lower than the rate after the infamous Smoot-Hawley tariff of 1930.

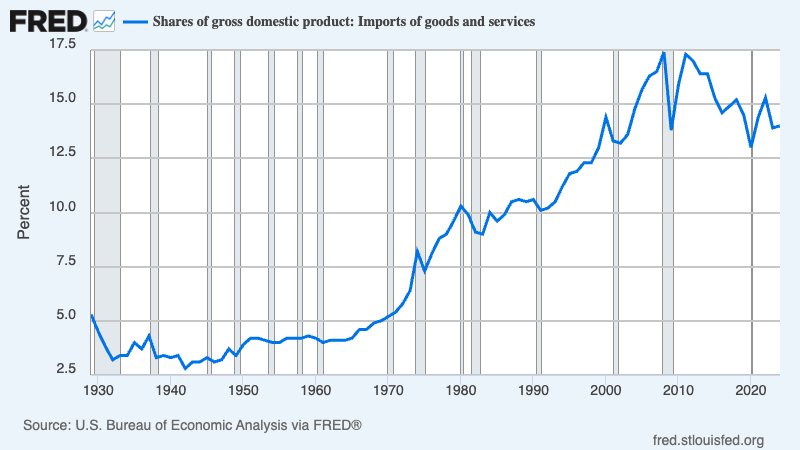

And bear in mind that Smoot-Hawley added to tariff rates that were already high, while this time we’re jumping from very low to very high tariffs almost instantly. Also, trade is far more important to the U.S. economy now than it was in 1930:

So even after Trump’s “climbdown” we’re still looking at a shock to the economy 7 or 8 times as big as Smoot-Hawley, the previous poster child for destructive tariff policy.

What will this shock do to international trade? Tariffs raise the price of imports (even if Trump insists otherwise), and higher prices reduce demand. So tariffs will lead to lower imports. How much lower?

The answer depends on the elasticity of demand — the percentage fall in imports for every one percent increase in their price.

Economists try to estimate this number by looking at how transportation costs affect the volume of trade between any two countries.

There’s a range of estimates, but let me go with 4, which is actually on the lower end.

Given this number, we’d expect Trump’s tariffs after last weekend’s retreat on China to cut overall U.S. trade by roughly 50 percent.

Trade with China, which would have been virtually eliminated with a 145 percent tariff rate, would fall by “only” around 65 percent with a 30 percent tariff.

Does cutting U.S. trade with the world in general by half and reducing trade with China by two thirds sound to you like Trump calling off his trade war?

It sounds to me like a massive disruption of the world economy, only slightly less disruptive than what we were looking at last week.

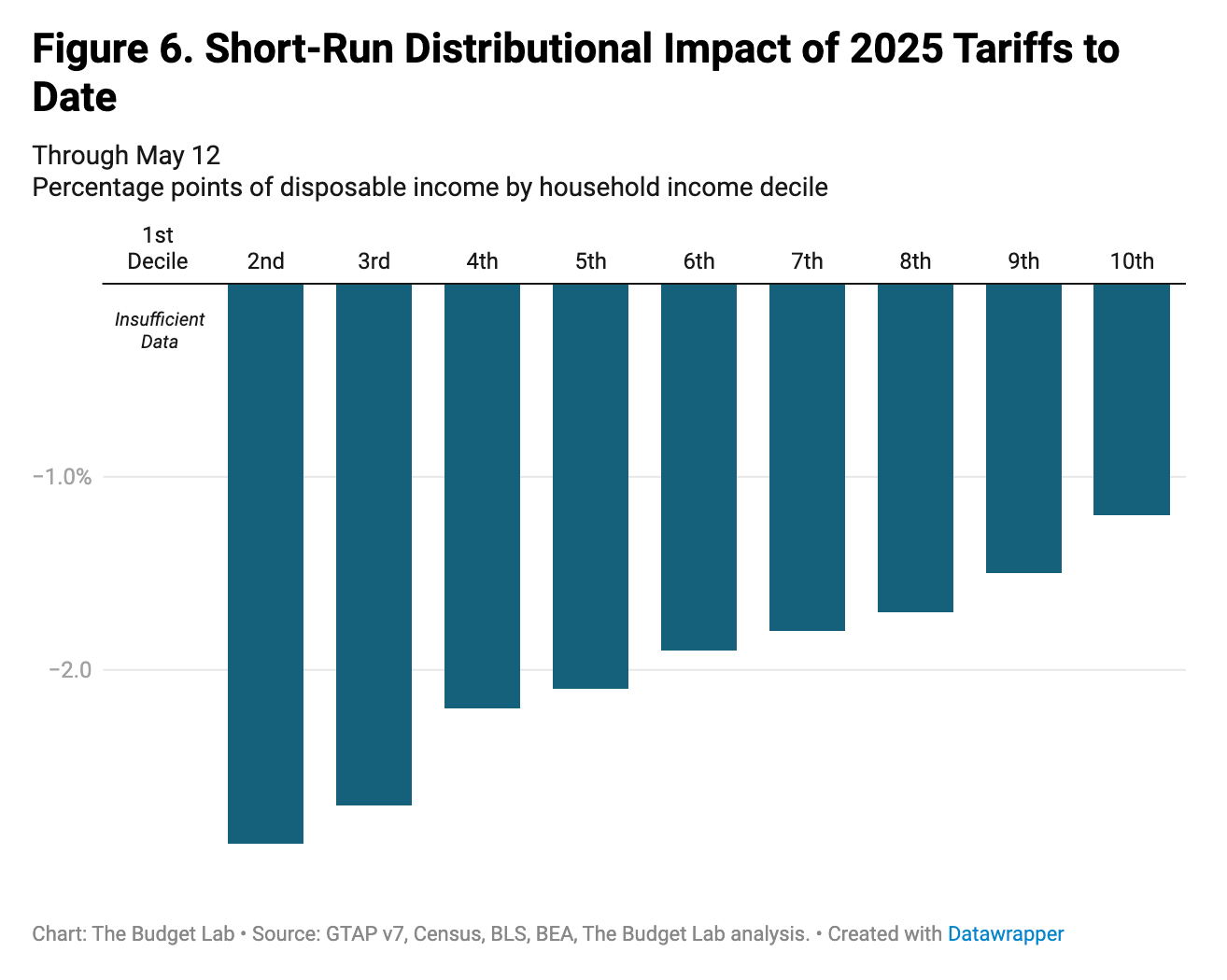

What about the impact on U.S. families? Tariffs are sales taxes levied on American households; don’t let anyone tell you different.

Walmart declared yesterday that it will have to begin raising prices later this month because of the tariffs.

And tariffs are regressive sales taxes that fall much more heavily on lower-income Americans than on the affluent, for three reasons.

First, low-income households spend a higher fraction of their income.

Second, compared with the affluent, poor and working-class families spend more on goods, which are facing tariffs, as opposed to services, which aren’t.

Finally, the goods whose prices will rise most tend to be items like clothing that loom large in lower-income families’ budgets.

The Budget Lab has estimated the effects of the new tariff plan on households’ purchasing power at different levels. This is a huge hit to real incomes in the lower parts of the income distribution:

Two further points about where we are right now on tariffs. First, nothing that has been announced is any kind of lasting commitment.

Everything is at most an announcement about what tariff rates will be for the next 90 days. Nobody, very much including Trump himself, knows what policy will be a few months from now.

We’re still living with huge uncertainty, which means an environment in which it’s impossible for businesses to make long-term plans.

Second, everything Trump is still doing on tariffs is a violation of longstanding international agreements.

You may think you’ve made a deal with America, but U.S. officials treat solemn deals like suggestions at best.

In other words, not much has changed since last week.

We may not be looking at the complete economic meltdown that seemed quite possible (and is still a possibility), but we’re still looking at much higher inflation and an economic slowdown at best — i.e., stagflation.

The interesting question, as I see it, is why so many pundits and reporters — and, it seems, small stock investors — have been sounding the all clear on Trump’s tariffs, when the reality is that all we’ve seen is a modest retreat from complete, destructive insanity to seriously harmful madness.

It’s hard to avoid the sense that what we’re seeing on tariffs is another version of the sanewashing that Trump has benefited from ever since he entered politics.

People just keep wanting to believe that he’s making sense, that he isn’t as ignorant and irresponsible as he seems. But he is.